Managing Insurance Claims Data Using AI

This article is the third installment in our series on leveraging AI to manage unstructured data effectively. Our first article introduced the concept of unstructured data and its significance, while the second installment explored how AI transforms receipt processing. In this section, we focus on a more complex challenge: how to use AI to extract and simplify unstructured data for Insurance claims data.

The Complexity of Insurance Claims Data Extraction

Insurance claims are notoriously difficult to manage due to their highly variable nature. Unlike structured financial transactions, claims involve extensive documentation, unstructured text, and, in many cases, supporting images.

Insurance documents can span multiple pages and often contain detailed narratives, legal clauses, medical reports, and various formats that make automated processing challenging.

Traditional methods rely heavily on manual review and rule-based systems, which are slow, prone to errors, and require predefined templates. Extracting key information—such as claim amounts, dates, policy numbers, and service descriptions—demands a more intelligent, adaptable solution.

Enhancing Claims Data Extraction with AI

To tackle this, we turned to AI. AI offers a more efficient way to extract, organize, and analyze claims data. In this example, we are focusing on one critical step of claims processing: efficiently gathering and structuring the multitude of claims data to make it accessible and usable for the downstream processes.

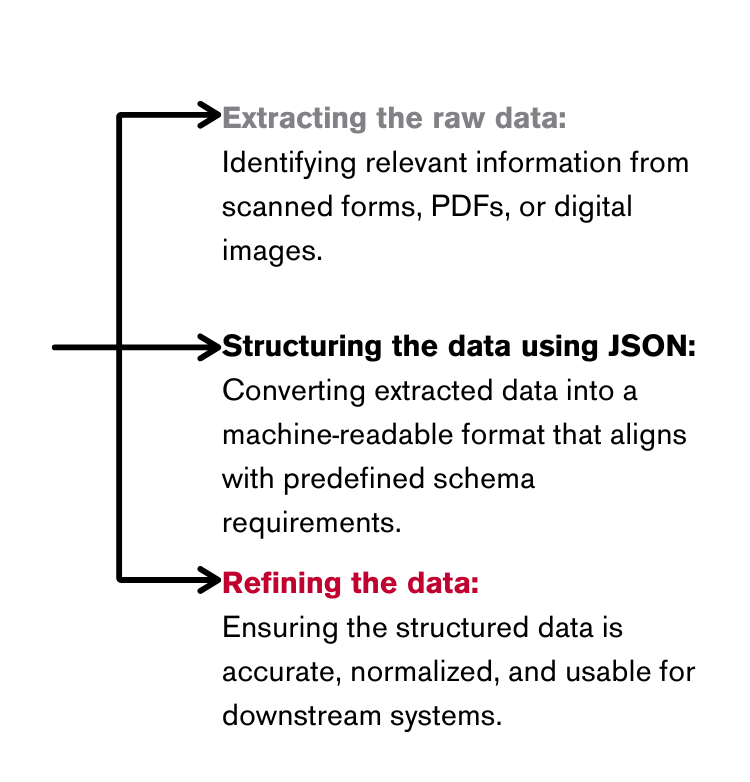

Instead of manually reviewing and inputting information, AI can extract unstructured data and convert it into a structured, usable format. Our AI-powered approach follows three key steps:

Extracting the Raw Data

The first step involves feeding insurance claim documents – whether scanned forms, PDFs, or digital images – into an AI model. The model identifies and extracts relevant information, recognizing:

- Key entities such as policyholders, claimants, and service providers

- Dates of service, claim submission, and approvals

- Financial details such as claim amounts and deductions

- Narrative descriptions and supporting documentation

Structuring the Data Using JSON

Once the raw data is extracted, AI organizes it into a structured JSON format. This step involves:

- Mapping extracted values to a predefined schema

- Standardizing data formats for consistency

- Handling variations in document layouts and terminology

- The structured JSON ensures the extracted data is ready for further processing or integration into insurance systems.

Refining the Data for the Database

With the structured JSON output, the AI model can refine the data to align with a relational database schema. This step involves:

- Cross-referencing extracted information with policyholder records

- Normalizing values to ensure consistency in reporting

- Translating text (if necessary) for multilingual claims

- Enhancing fraud detection by flagging anomalies in claim amounts or repeated submission patterns.

Making the Data Usable

Insurance providers can use this three-step process to convert unstructured information into a structured, actionable format. This eliminates the need for time-consuming manual data entry and improves accuracy without requiring complex and inflexible data mapping.

To demonstrate this process, we developed an interactive demo that showcases how AI extracts, structures, and refines claims data. This demo illustrates how the model:

- Identifies and categorizes information from claim documents

- Extracts key details such as dates, loss amounts, and claim causes

- Seamlessly integrates structured data into a usable format for downstream processes

While this demo is not a market-ready product, we wanted a lightweight user interface to enhance usability, allowing users to review and interact with processed records. This demo effectively demonstrates how AI converts unstructured claims data into structured formats, enabling users to verify accuracy and adjust as needed. It provides a model of what insurance companies can build using the three-step process:

Benefits of AI-Powered Claims Data Extraction

AI-driven data extraction offers significant advantages for handling unstructured claims data, making it more efficient, accurate, and scalable. One way to see this is through the demo, which illustrates how AI can extract and organize claims data into a structured format. However, depending on specific business needs, this technology can be applied beyond the demo. Using AI for unstructured data will help insurance workflows by:

Increased Efficiency

AI extracts data from lengthy, unstructured documents, reducing insurance teams’ time on manual entry and review. By streamlining this process, teams can focus on higher-value tasks rather than administrative work.

Improved Accuracy and Consistency

AI eliminates human errors by extracting and structuring data in a standardized way. This approach reduces inconsistencies and ensures greater reliability in claim information.

Scalability for Large Volumes of Data

AI-powered extraction processes can handle fluctuating claim volumes without requiring additional staff. Whether handling a small number of claims or thousands, automation structures data efficiently and consistently.

Better Decision-Making with Structured Data

AI formats extracted information for easy integration into existing systems. Businesses can use structured claims data for analytics, reporting, and other processes, enabling faster, more informed decision-making.

What’s next for your unstructured data?

AI’s role in claims data extraction will become more integral as it evolves.

Advancements will likely include more sophisticated natural language processing (NLP) models, enhanced image recognition for document verification, and deeper integrations with insurance systems for seamless automation.

Organizations that embrace AI for claims processing will improve efficiency and accuracy and gain a competitive edge in delivering faster, more reliable services. The transformation from manual processing to AI-driven automation marks a significant shift in how insurers will handle complex, unstructured data.

In the next installment, we’ll explore another critical use case where AI plays a transformative role.